Navigating Today's Real Estate Market: Understanding the Impact of Mortgage Rates

As Tina Pries of Pries Capital Real Estate, I've watched the ebb and flow of the housing market with keen interest, especially through the unprecedented times of the last decade. Today, I want to delve into an aspect that's shaping the current real estate landscape: mortgage rates. Understanding the distribution and impact of interest rates on fixed-rate mortgages is crucial for anyone looking to buy, sell, or invest in real estate today.

The Surge and Shift of Mortgage Rates

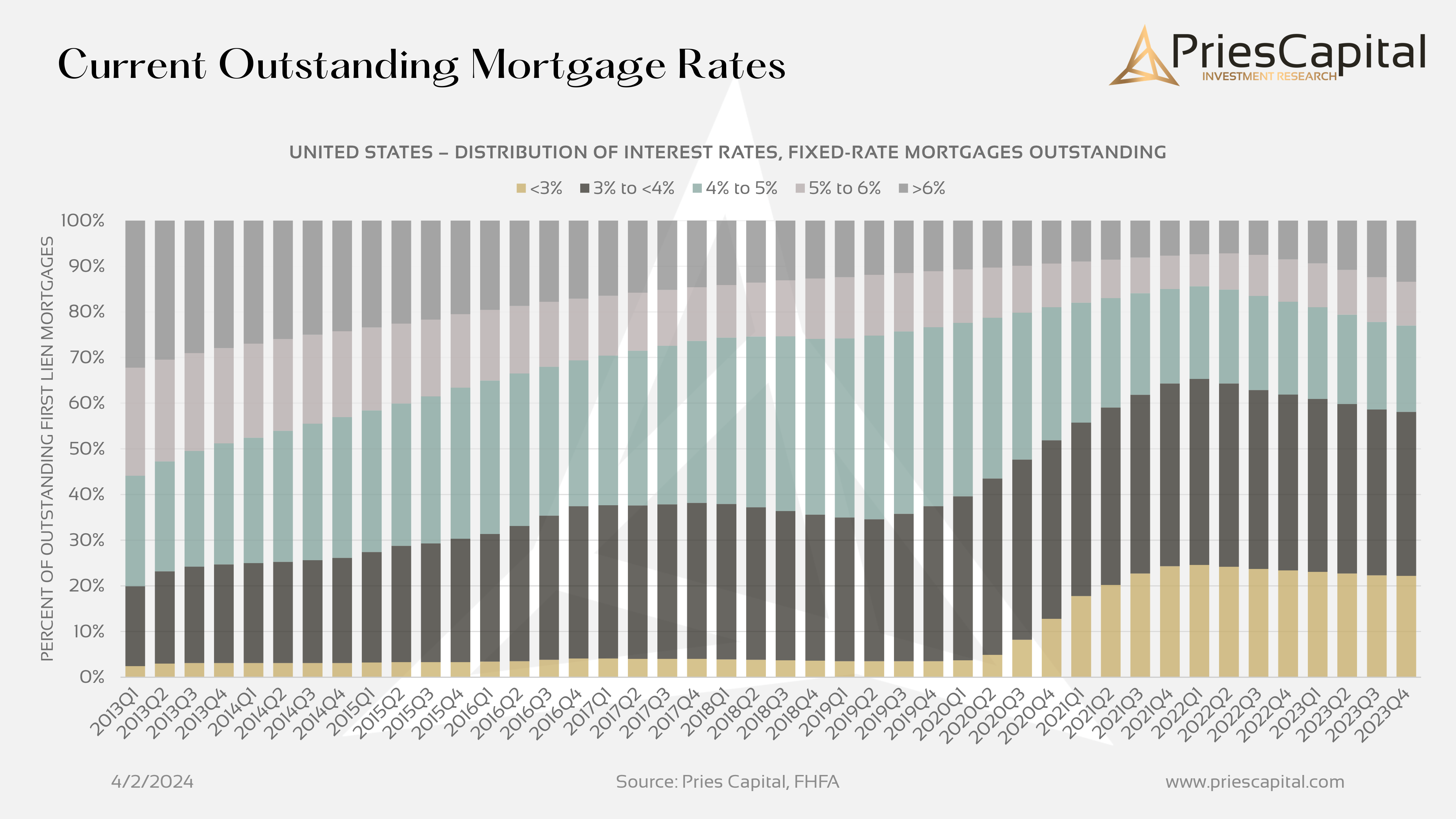

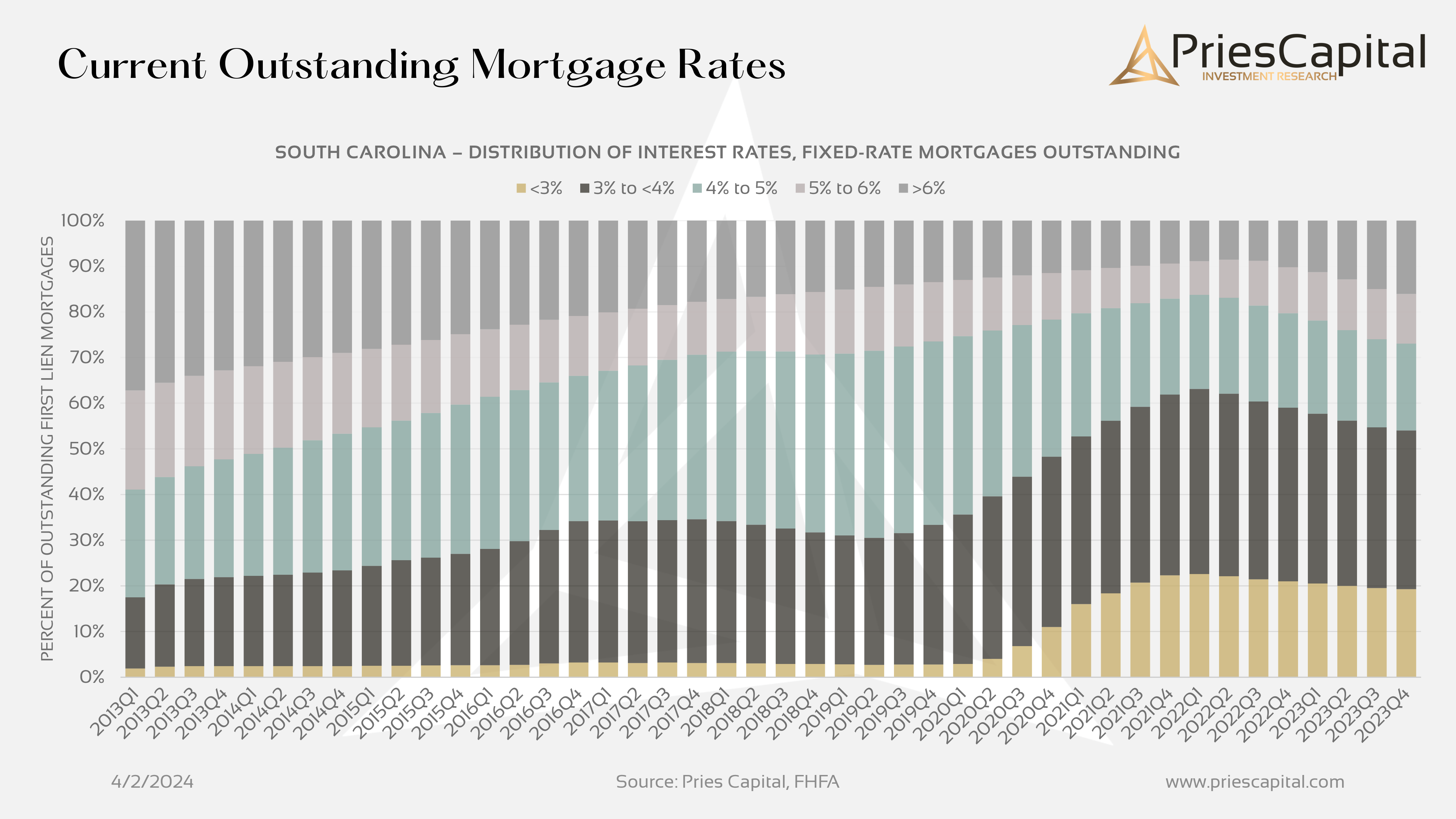

The landscape of mortgage rates has undergone significant changes since early 2020, influenced largely by the global pandemic. Data tracking the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages from Q1 2013 through Q4 2023 reveals a fascinating trend: a sharp decline in mortgage rates beginning in early 2020, leading to a surge in the percentage of loans under 3% and under 4%.

By Q1 2022, the percentage of outstanding loans under 4% reached its peak at 65.3%, with loans under 5% peaking at 85.6%. These figures represented a boon for homeowners, providing them with historically low rates that, in many cases, made the idea of selling and buying anew less appealing due to the potential for increased monthly payments. This phenomenon has contributed to the low levels of existing home inventory, a pivotal factor in today's market dynamics.

Rising Rates and Market Implications

The trend took a turn by Q2 2022, with the percentage of loans over 6% bottoming out at 7.2% and rising to 13.4% by Q4 2023. This shift indicates a tightening market, where higher mortgage rates are beginning to make their mark on affordability and the decision-making process of homeowners and potential buyers.

The Challenge of Low Inventory

One of the critical outcomes of the low-interest environment has been the reluctance among homeowners to sell. With such favorable rates locked in, the prospect of acquiring a new mortgage at a higher rate discourages many from listing their homes, leading to a scarcity in available properties. This scarcity is a key driver behind the competitive nature of today's real estate market, with bidding wars and above-asking price offers becoming increasingly common.

Opportunities in the Current Market

Despite these challenges, opportunities abound for informed buyers and sellers. For sellers, the low inventory levels mean that well-priced homes in desirable locations can attract significant interest and premium offers. Buyers, on the other hand, may find that the increasing rates necessitate a more strategic approach to the market, focusing on value and potential long-term gains.

Navigating the Market with Pries Capital Real Estate

At Pries Capital Real Estate, we understand the complexities of today's market. Whether you're looking to buy your first home, sell your current property, or expand your investment portfolio, our expertise and personalized approach can guide you through the intricacies of the real estate process. We're here to help you make informed decisions that align with your financial goals and lifestyle aspirations.

In conclusion, while the current mortgage rates present challenges, they also offer a unique landscape for strategic real estate decisions. By staying informed and leveraging professional guidance, you can navigate this dynamic market with confidence.

For more insights and assistance with your real estate needs, contact us at Pries Capital Real Estate. Let's turn your real estate goals into realities.